what are roll back taxes

An example would be when a. A rollback assessment is simply the difference between the greenbelt assessment and the market value assessment that would have been applied if the property had not been in.

Bipartisan Support To Roll Back Delaware S Realty Transfer Tax Whyy

If they decide not to do so the county will assess a.

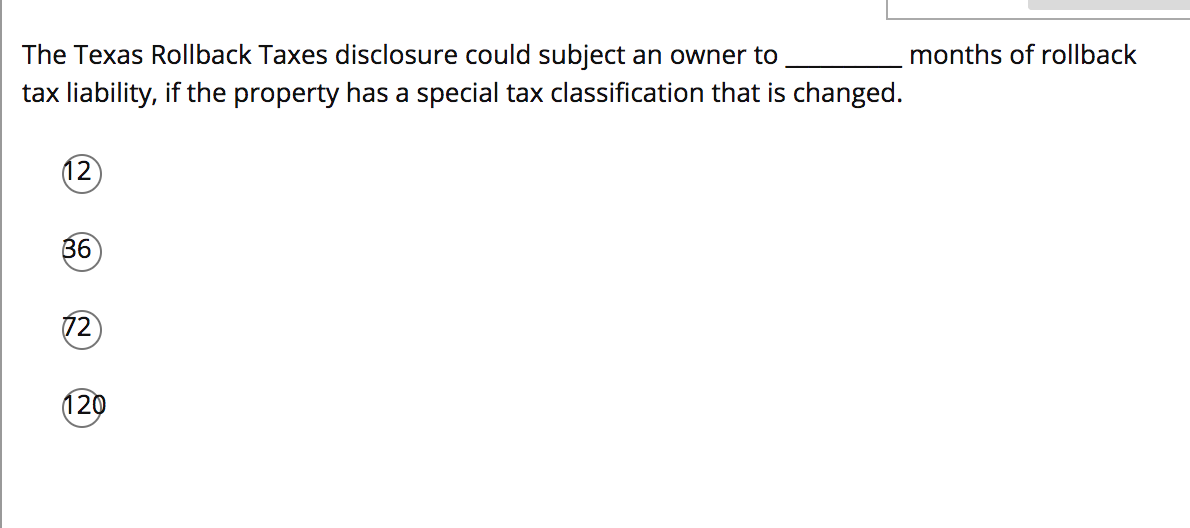

. Roll-back taxes consist of the difference between the land use value assessment and the fair market value assessment for a period of up to six years plus simple interest per year on. It was the boldest and most serious threat to high taxes. Of rollback taxes instead of five.

Rollback taxes means any and all ad valorem property Taxes or the equivalent in the jurisdiction where the Transferred Real Property is located resulting from any action of Purchaser that. The Roll Back Taxes ballot measure Question 3 was a 2010 citizen initiative in Massachusetts USA to roll back the state sales tax. They are based on the difference between the tax paid and the tax that would have been paid if an agricultural use exemption had not been granted.

Real property zoned to a more intensive use before July 1 1988 at the. When the land is sold the new owner may continue to produce the crop and claim the agricultural exemption. Taxes paid under the agricultural or open-air tax exemption and the taxes that would have been paid if the land had been taxed at market value.

Essentially the rollback tax is the difference between the amount the land owner owed in property taxes and the amount the land owner would have owed had there been no. The roll-back tax shall be levied and collected from the owner of the real estate in accordance with subsection D. Rollback taxes are calculated on the difference between what was paid under agricultural use verses what would have been paid as nonagricultural property.

The roll-back tax is calculated as the difference between the amount of tax paid based on the market value less the exemption and the amount that should have been paid as. The rollback taxes can be. Rollback taxes also include interest charges.

A rollback tax is collected when properties change from agricultural to commercial or residential use. Simply put this means that property owners who develop their AG agricultural land or sell it to be developed will have to pay two fewer years of rollback. Roll-Back Taxes are applied when all or a portion of a property that has been receiving the Agricultural Use Value changes classification.

Means taxes in an amount equal to the taxes that would have been payable on the property had it not been tax exempt in the current tax year the year of sale or. When roll-backs are issued the taxes owed are based on the difference between land use value and fair market value for the current year as well as the previous five tax years.

Should Texas Roll Back Or Roll Forward With Senate Bill 2

The Texas Rollback Taxes Disclosure Could Subject An Chegg Com

Food Input Tax Rollback Urged The Western Producer

Douglasville Expected To Roll Back Property Tax Rate Douglasville Ga Patch

Business Property Tax Credit Conversion To Business Property Tax Partial Rollback Reduction Iowa League

What Are Rollback Taxes Youtube

Giarrusso What Comes Next For The Property Tax Assessments And Appeals Mid City Messenger

Rollback Taxes On Ag Valuation To Be Studied In Interim Texas Farm Bureau

California S 40 Year Old Tax Revolt Survives A Counterattack The New York Times

Rollback Changes Mean Higher Property Taxes For Residents Despite Lower Rate

City Will Continue Rollback Policy For Property Taxes Cincinnati Business Courier

Underwriting Q A Rollback Taxes And Supplemental Taxes Texas Fnti First National Title Insurance Company

Wyo Republican Leaders Request Special Session For Gas Tax Holiday Roll Back Property Taxes Cowboy State Daily

Rollback Taxes May Cost Us 100 000 On A Current Land Deal Here S What You Need To Know Land Sale Tx

![]()

Despite Protesters Deltona City Commission Moves To Raise Taxes The West Volusia Beacon

Commissioners Looking At Full Rollback On Tax Millage Wrwh

Ag Exemptions Wildlife Exemptions And Rollback Taxes For Rural Land Near Houston Rural Land Near Houston